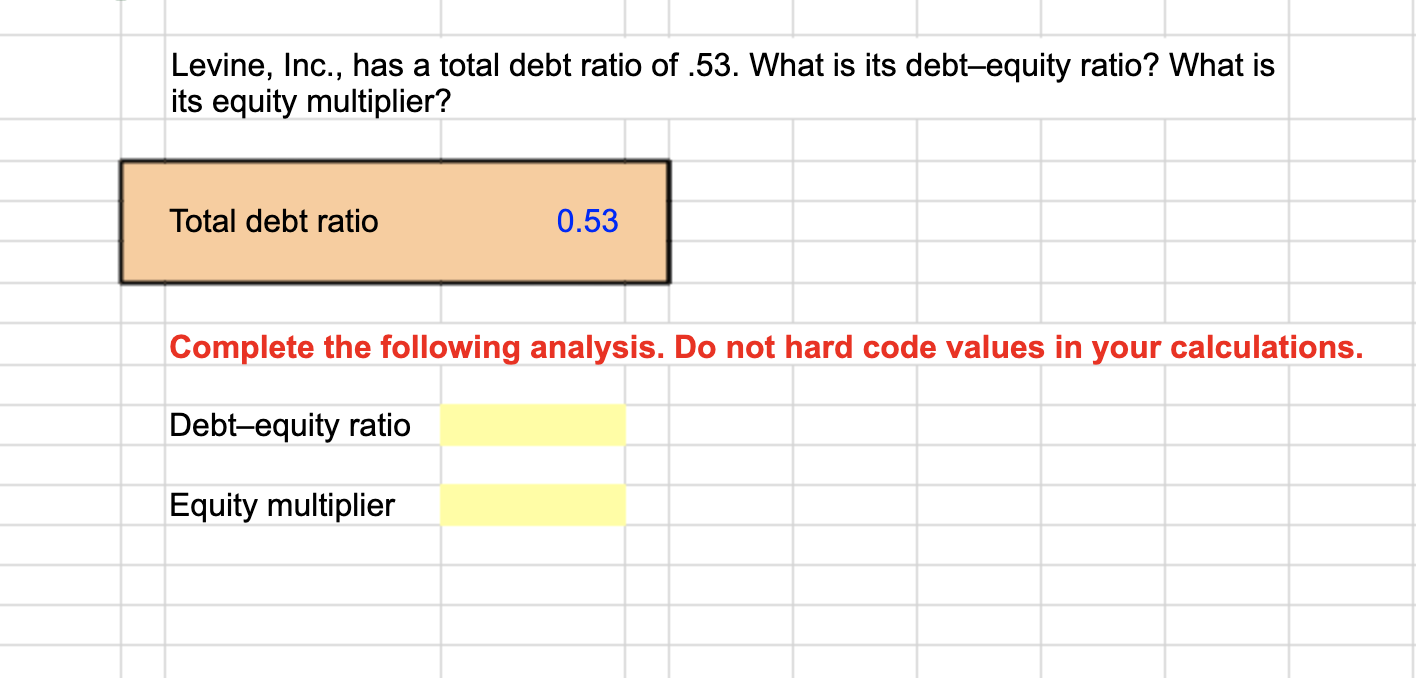

Levine Inc Has a Total Debt Ratio of .53

What is its Boyd Inc has a total debt ratio of 045. Why do consumers of services perceive higher levels of risk associated with Why do consumers of services perceive higher levels of risk associated with their purchases compared to goods purchases.

Chapter 3 Hw Docx 1 Levine Inc Has A Total Debt Ratio Of 48 What Is Its Debt Equity Ratio What Is Its Equity Multiplier Explanation Total Course Hero

What is its equity multiplier.

. Current liabilities are 2475 sales are 10705 profit margin is 11 percent and ROE is 16 percent. Y3K Inc has sales of 6219 total assets of 2835 and a debt-equity ratio of 150. Shelton Inc has sales of 175 million total assets of 131 million and total debt of 57 million.

What is its debt-equity ratio. Do not round intermediate calculations. If the profit margin is 6 percent what is net income.

What is its debt-equity ratio. Sales Net income Profit margin 188000 970 193814433 Credi. What is equity multiplier.

What is its debt-equity ratio. What is its debt equity ratio. Long-term debt ratio 54 Current ratio 143 Current liabilities 2475 Sales 10705.

Schism Inc has a total debt ratio of 070 total debt of 265000 and net income of 24850. What is its debt equity ratio. For the past year the company has net income of 91 million total equity of 247 million sales of 496.

Calculating Leverage Ratios Levine Inc has a total debt ratio of 53. Now we can use the long-term debt ratio to find the total long-term debt. 53 debt-equity ratio total debt total equity -- tot debt raio total debt total assets tot de tot debt 53 x tot debt 53 x tot equity 47 x tot debt 53 x tot equity tot debt tot equity 53 47 debt-equity ratio total debt total equity 53 47.

Calculating Leverage Ratios LO2 Levine Inc has a total debt ratio of 53. Step 1 of 4. What is the equity multiplier.

1Long-term debt ratio 1 Total equityLong-term debt 153 1 Total equityLong-term debt Total equityLong-term debt 89 712667Long-term debt 89. What is its debt-equity ratio. Y3K Inc has sales of 6189 total assets of 2805 and a debt-equity ratio of 140.

Debt-equity ratio 53 Total DebtTotal Assets53 total debttotal debt total equity53 total equity 47 total debt 4753 088 Equity Multiplier 1 debt-equity ratio. What is its equity multiplier. Long-term debt ratio Long-term debtLong-term debt Total equity Inverting both sides we get.

Boyd Inc has a total debt ratio of 045. Levine Inc has a total debt ratio of 53. The only DuPont Identity ratio not given is the profit margin.

Wilson Inc has a current stock price of 64. Levine Inc has a total debt ratio of 48. Levine Inc has a total debt ratio of 53.

Boyd Inc has a total debt ratio of 045. What is its equity multiplier. Round your answer to 2 decimal places eg 3216 Equity multiplier.

The Plainfield Company has a long-term debt ratio ie the ratio of long-term debt to long-term debt plus equity of 54 and a current ratio of 143. When the valve on. Debt to equity ratio provides the long-term financial soundness of the company.

If its return on equity is 10 percent what is its net income. What is its equity multiplier. Levine Inc has a total debt ratio of 53.

48 TE 52 TD Debt-equity ratio TD TE Debt-equity ratio 48 52 Debt-equity ratio 92 Equity multiplier 1 DE. What is the companys return on equity. What is its equity multiplier.

What is its debt-e Total Debt Ratio 053 Receivables Turnover 113 D71-D7 Days sales in receivables 213 11-D7. What is its debt-equity ratio. Levine Inc has a total debt ratio of 053.

What is its Boyd Inc has a total debt ratio of 045. 48 TD TD TE Solving this equation yields. Levine Inc has a total debt ratio of 053.

Debt to Equity Ratio. What is the companys return on equity. Levine Inc has a total debt ratio of 43.

What is the debt-equity ratio. Round your answer to 2 decimal places eg 3216 Debt-equity ratio What is its equity multiplier. Calculating Leverage Ratios L02 Levine Inc has a total debt ratio of 53.

This is a multistep problem involving several ratios. What is its debt-equity ratio. If its return on equity is 13 percent what is its net income.

Total debt ratio 48 TD TA Substituting total debt plus total equity for total assets we get. What is its equity multiplier. Eg 3216 Net income.

What is its equity multiplier. Total debt ratio 36 TD TA Substituting total debt plus total equity for total assets we get36 TD TD TE Solving this equation yields36TE 64TD Debt-equity ratio TD TE Debt-equity ratio 36 64 Debt-equity ratio 56 Equity multiplier 1 DE Equity multiplier 156. By signing up youll get.

What is its debt-equity ratio. Levine Inc has a total debt ratio of 49. Do not round intermediate calculations.

It shows the relationship between total liabilities and total equity. Carroll Inc has a total debt ratio of 75 total debt of 353000 and net income of 18750. What is its equity multiplier.

Do not round intermediate calculations and round your final answer to 2 decimal places. View the full answer. The ratios given are all part of the DuPont Identity.

What is its debt-equity ratio. Debt-equity ratio Total debt Total equity Total debt ratio Total debt Total assets Total debt Total debt Total equity 053 Total debt 053 Total debt 053 Total equity 047 Total debt 053 Total equity Total debt Total.

Solved I Know The Answer But I Need Help The Question Is Chegg Com

Solved Levine Inc Has A Total Debt Ratio Of 53 What Is Chegg Com

Solved Levine Inc Has A Total Debt Ratio Of 53 What Is Chegg Com

No comments for "Levine Inc Has a Total Debt Ratio of .53"

Post a Comment